Markowitz Portfolio Optimization¶

What Is Markowitz Portfolio Optimization?¶

At its core, Markowitz Portfolio Optimization is about finding the right mix of assets that will give you the highest expected return for a given level of risk (or the least risk for a given return). The theory suggests that investors should not look at individual investments in isolation, but rather, how they work together in a portfolio.

Markowitz’s main contribution was the realization that combining different types of investments — stocks, bonds, real estate, etc. — can reduce the overall risk of a portfolio without necessarily lowering its expected return. This insight came from understanding that assets do not move in perfect harmony. Some investments rise when others fall, and this diversification can smooth out the bumps of the market, creating a more stable, efficient investment strategy.

Key Concepts¶

Risk and Return¶

Risk and return are two sides of the same coin. In simple terms:

- Return is the gain or profit you expect from your investments.

- Risk is the uncertainty or potential for loss in an investment. This is often measured by volatility, or how much an investment’s value fluctuates.

The fundamental goal of Markowitz’s theory is to find the optimal combination of assets that maximizes return for a given level of risk.

Diversification¶

Diversification is the cornerstone of Markowitz’s theory. By holding a variety of investments, you reduce the impact of any single asset’s performance on the overall portfolio. The key is to choose assets that don’t move in the same direction. For example, when stock prices are falling, bond prices may be rising. By combining assets with low or negative correlations, you can lower the portfolio's risk.

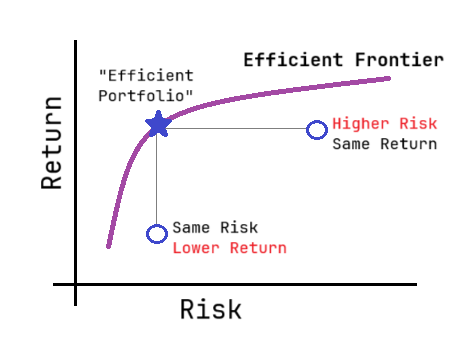

The Efficient Frontier¶

The Efficient Frontier is a curve that shows the optimal portfolios offering the highest expected return for a given level of risk. Portfolios below this curve are suboptimal, as they either offer lower returns for the same risk or higher risk for the same return.

Graph Axes:

- The x-axis is Risk

- The y-axis is Return

The Curve

- The curve starts at the least risky portfolio and curves upward as you take on more risk for higher returns.

- Portfolios below the curve are bad deals—they have too much risk for the return they offer.

- Portfolios on the curve are the best deals—they balance risk and return.

Benefits and Limitations¶

Benefits¶

- Encourages diversification, reducing portfolio risk.

- Provides a systematic, data-driven approach to portfolio construction.

- Helps visualize trade-offs between risk and return.

Limitations¶

- Assumes historical data predicts future performance.

- Relies on estimates of returns and covariances, which can be inaccurate.

- Treats risk as variance, which penalizes upside volatility (positive surprises).

The Markowitz Optimization Model¶

Portfolio Return¶

The expected return of a portfolio is the weighted sum of the individual asset returns:

$$

E(R_p) = \sum_{i=1}^n w_i E(R_i)

$$

Here:

- $ E(R_p) $: Portfolio’s expected return

- $ w_i $: Weight (percentage) of the portfolio invested in asset $i$

- $ E(R_i) $: Expected return of asset $i$

Portfolio Risk (Variance)¶

Risk is captured by the variance (or standard deviation) of returns. For a portfolio:

$$

\sigma_p^2 = \sum_{i=1}^n \sum_{j=1}^n w_i w_j \text{Cov}(R_i, R_j)

$$

Where:

- $ \sigma_p^2 $: Portfolio variance

- $ \text{Cov}(R_i, R_j) $: Covariance between the returns of assets $i$ and $j$

Covariance measures how the returns of two assets move together. Diversification benefits arise when assets are negatively correlated or have low covariance.

The Optimization Problem¶

The goal is to solve this constrained optimization problem:

$$ \text{Maximize } E(R_p) \text{ for a given level of } \sigma_p^2 $$

Or equivalently:

$$ \text{Minimize } \sigma_p^2 \text{ for a given level of } E(R_p) $$

Subject to:

- $\sum_{i=1}^n w_i = 1$ (The weights must sum to 1, i.e., you invest all your money.)

- $w_i \geq 0$ (Non-negativity constraint if short-selling is not allowed.)

# Import libraries

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import yfinance as yfin

from scipy.optimize import minimize

import warnings

warnings.filterwarnings('ignore')

Download data¶

We are going to use 10 different stocks in several sectors (Technology, Healthcare, Finance, and Retail)

stocks = [

{"symbol": "AAPL", "name": "Apple Inc."},

{"symbol": "MSFT", "name": "Microsoft Corporation"},

{"symbol": "AMZN", "name": "Amazon.com Inc."},

{"symbol": "TSLA", "name": "Tesla Inc."},

{"symbol": "JNJ", "name": "Johnson & Johnson"},

{"symbol": "PFE", "name": "Pfizer Inc."},

{"symbol": "JPM", "name": "JPMorgan Chase & Co."},

{"symbol": "V", "name": "Visa Inc."},

{"symbol": "PG", "name": "Procter & Gamble Co."},

{"symbol": "XOM", "name": "Exxon Mobil Corporation"}

]

symbols = [st['symbol'] for st in stocks]

# Download the Daily closing price for the last 10 years

stock_df = yfin.download(symbols, period="10y")['Adj Close']

[*********************100%%**********************] 10 of 10 completed

stock_df

| Ticker | AAPL | AMZN | JNJ | JPM | MSFT | PFE | PG | TSLA | V | XOM |

|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||

| 2014-11-24 | 26.418226 | 16.782000 | 81.752777 | 46.244347 | 40.865200 | 19.331116 | 66.516785 | 16.448000 | 59.352398 | 61.911777 |

| 2014-11-25 | 26.188854 | 16.752001 | 81.615082 | 45.743679 | 40.762161 | 19.491039 | 67.037674 | 16.539333 | 59.967785 | 61.303799 |

| 2014-11-26 | 26.500629 | 16.678499 | 82.005203 | 45.774017 | 41.002590 | 19.894043 | 67.098068 | 16.562668 | 59.967785 | 61.109768 |

| 2014-11-28 | 26.485031 | 16.931999 | 82.800697 | 45.637470 | 41.054115 | 19.926027 | 68.268211 | 16.301332 | 60.184582 | 58.561356 |

| 2014-12-01 | 25.625439 | 16.299999 | 82.632408 | 45.516094 | 41.749657 | 19.996380 | 68.003967 | 15.442667 | 60.175240 | 59.732059 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2024-11-18 | 228.020004 | 201.699997 | 154.770004 | 245.029999 | 414.929474 | 24.860001 | 170.750000 | 338.739990 | 312.160004 | 120.309998 |

| 2024-11-19 | 228.279999 | 204.610001 | 153.000000 | 243.089996 | 416.955414 | 25.100000 | 170.759995 | 346.000000 | 311.850006 | 118.629997 |

| 2024-11-20 | 229.000000 | 202.880005 | 153.110001 | 240.779999 | 414.659973 | 24.940001 | 170.889999 | 342.029999 | 307.390015 | 120.320000 |

| 2024-11-21 | 228.520004 | 198.380005 | 155.500000 | 244.759995 | 412.869995 | 25.129999 | 172.750000 | 339.640015 | 309.899994 | 121.930000 |

| 2024-11-22 | 230.514999 | 198.095001 | 155.020004 | 248.419998 | 415.035004 | 25.605000 | 177.399994 | 354.250000 | 308.684998 | 121.940002 |

2517 rows × 10 columns

stock_df.info()

<class 'pandas.core.frame.DataFrame'> DatetimeIndex: 2517 entries, 2014-11-24 to 2024-11-22 Data columns (total 10 columns): # Column Non-Null Count Dtype --- ------ -------------- ----- 0 AAPL 2517 non-null float64 1 AMZN 2517 non-null float64 2 JNJ 2517 non-null float64 3 JPM 2517 non-null float64 4 MSFT 2517 non-null float64 5 PFE 2517 non-null float64 6 PG 2517 non-null float64 7 TSLA 2517 non-null float64 8 V 2517 non-null float64 9 XOM 2517 non-null float64 dtypes: float64(10) memory usage: 216.3 KB

# plot stock closing price over time

stock_df.plot(figsize=(10,5));

Daily Returns¶

Now, we are going to calculate the daily returns of these stocks

daily_returns = stock_df.pct_change(1).dropna()

daily_returns.plot(figsize=(10,5));

daily_returns['AAPL'].plot(kind='hist',bins=100,figsize=(12,3));

Cumulative Returns¶

cumulative_returns = (1 + daily_returns).cumprod() - 1

cumulative_returns_perc = cumulative_returns*100

cumulative_returns_perc.plot(figsize=(10,5));

Log Returns¶

# Log Returns as Percent of next day

log_returns = np.log(stock_df/stock_df.shift(1))

log_returns

| Ticker | AAPL | AMZN | JNJ | JPM | MSFT | PFE | PG | TSLA | V | XOM |

|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||

| 2014-11-24 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 2014-11-25 | -0.008720 | -0.001789 | -0.001686 | -0.010886 | -0.002525 | 0.008239 | 0.007800 | 0.005537 | 0.010315 | -0.009869 |

| 2014-11-26 | 0.011835 | -0.004397 | 0.004769 | 0.000663 | 0.005881 | 0.020466 | 0.000900 | 0.001410 | 0.000000 | -0.003170 |

| 2014-11-28 | -0.000589 | 0.015085 | 0.009654 | -0.002988 | 0.001256 | 0.001606 | 0.017289 | -0.015904 | 0.003609 | -0.042597 |

| 2014-12-01 | -0.032994 | -0.038040 | -0.002035 | -0.002663 | 0.016800 | 0.003524 | -0.003878 | -0.054113 | -0.000155 | 0.019794 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2024-11-18 | 0.013333 | -0.004502 | 0.004988 | -0.001142 | 0.001830 | 0.002416 | 0.007112 | 0.054664 | 0.008106 | 0.008347 |

| 2024-11-19 | 0.001140 | 0.014324 | -0.011502 | -0.007949 | 0.004871 | 0.009608 | 0.000059 | 0.021206 | -0.000994 | -0.014062 |

| 2024-11-20 | 0.003149 | -0.008491 | 0.000719 | -0.009548 | -0.005520 | -0.006395 | 0.000761 | -0.011540 | -0.014405 | 0.014145 |

| 2024-11-21 | -0.002098 | -0.022430 | 0.015489 | 0.016394 | -0.004326 | 0.007589 | 0.010825 | -0.007012 | 0.008132 | 0.013292 |

| 2024-11-22 | 0.008692 | -0.001438 | -0.003092 | 0.014843 | 0.005230 | 0.018725 | 0.026562 | 0.042117 | -0.003928 | 0.000082 |

2517 rows × 10 columns

# Notice how close this is to our original returns!

stock_df.pct_change(1)

| Ticker | AAPL | AMZN | JNJ | JPM | MSFT | PFE | PG | TSLA | V | XOM |

|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||

| 2014-11-24 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 2014-11-25 | -0.008682 | -0.001788 | -0.001684 | -0.010827 | -0.002521 | 0.008273 | 0.007831 | 0.005553 | 0.010368 | -0.009820 |

| 2014-11-26 | 0.011905 | -0.004388 | 0.004780 | 0.000663 | 0.005898 | 0.020676 | 0.000901 | 0.001411 | 0.000000 | -0.003165 |

| 2014-11-28 | -0.000589 | 0.015199 | 0.009701 | -0.002983 | 0.001257 | 0.001608 | 0.017439 | -0.015779 | 0.003615 | -0.041702 |

| 2014-12-01 | -0.032456 | -0.037326 | -0.002032 | -0.002660 | 0.016942 | 0.003531 | -0.003871 | -0.052675 | -0.000155 | 0.019991 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2024-11-18 | 0.013422 | -0.004491 | 0.005000 | -0.001141 | 0.001831 | 0.002419 | 0.007137 | 0.056186 | 0.008138 | 0.008382 |

| 2024-11-19 | 0.001140 | 0.014427 | -0.011436 | -0.007917 | 0.004883 | 0.009654 | 0.000059 | 0.021432 | -0.000993 | -0.013964 |

| 2024-11-20 | 0.003154 | -0.008455 | 0.000719 | -0.009503 | -0.005505 | -0.006374 | 0.000761 | -0.011474 | -0.014302 | 0.014246 |

| 2024-11-21 | -0.002096 | -0.022181 | 0.015610 | 0.016530 | -0.004317 | 0.007618 | 0.010884 | -0.006988 | 0.008165 | 0.013381 |

| 2024-11-22 | 0.008730 | -0.001437 | -0.003087 | 0.014953 | 0.005244 | 0.018902 | 0.026917 | 0.043016 | -0.003921 | 0.000082 |

2517 rows × 10 columns

def gen_weights(n):

source = np.random.random(n)

# pos = np.random.randint(0,n)

# source[pos] = 10

weights = np.random.dirichlet(source,size=1)

return np.array(weights[0])

Portfolio Returns Function¶

def calculate_returns(weights):

return np.sum(log_returns.mean()*weights) * 252 #Annualized Returns

Portfolio Volatility (Variance) Function¶

log_returns_cov = log_returns.cov() # Covariance

def calculate_volatility(weights):

annualized_cov = np.dot(log_returns_cov*252,weights)

vol = np.dot(weights.transpose(),annualized_cov)

return np.sqrt(vol)

Montecarlo¶

Now we just create many, many random weightings, and we can then plot them on expected return vs. expected volatility (coloring them by Sharpe Ratio):

n = len(stock_df.columns)

mc_portfolio_returns = []

mc_portfolio_vol = []

mc_weights = []

for sim in range(100000):

# This may take a while!

weights = gen_weights(n)

mc_weights.append(weights)

mc_portfolio_returns.append(calculate_returns(weights))

mc_portfolio_vol.append(calculate_volatility(weights))

# Sharpe Ratios

mc_sharpe_ratios = np.array(mc_portfolio_returns)/np.array(mc_portfolio_vol)

# Plot Results

plt.figure(dpi=200,figsize=(10,5))

plt.scatter(mc_portfolio_vol,mc_portfolio_returns,c=mc_sharpe_ratios)

plt.ylabel('Expected Returns')

plt.xlabel('Expected Volatility')

plt.colorbar(label='Sharpe Ratio');

# Portfolio from the MonteCarlo simulation that maximizes the Sharpe Ratio

portfolio_mc_sr = mc_weights[np.argmax(mc_sharpe_ratios)]

portfolio_mc_sr

array([4.72203516e-02, 1.36616169e-01, 2.09472211e-02, 1.87584923e-01,

3.99647867e-01, 4.05349264e-09, 1.38906542e-01, 6.74778789e-02,

1.59904258e-03, 4.00561676e-12])

Optimal Weighting through Minimization Search¶

# Objective Function

def objective(weight):

# Note -1* because we are minimizing. It is the same as maximizing the positive sharpe ratio

return -1 * (calculate_returns(weight)/calculate_volatility(weight))

# Bounds of the decision variables (weights)

bounds = tuple((0,1) for _ in range(n))

# Constraint - All weights to add up to 1

sum_constraint = ({'type': 'eq', 'fun': lambda weight: np.sum(weight)-1})

# Starting Guess

equal_weights = n * [1/n]

results = minimize(fun=objective,x0=equal_weights,bounds=bounds,constraints=sum_constraint)

portfolio_optimal_sr = results.x

portfolio_optimal_sr

array([1.13971593e-01, 1.94361952e-01, 0.00000000e+00, 1.71332999e-01,

2.55048319e-01, 9.63313630e-17, 2.09921478e-01, 5.53636596e-02,

2.03287907e-18, 6.27482007e-18])

Results comparison¶

# Create x-axis positions for groups

x = np.arange(n) # Positions for each stock

width = 0.4 # Width of each bar

# Create the bar plot

plt.figure(figsize=(10, 5))

plt.bar(x - width/2, portfolio_mc_sr, width, label='MonteCarlo') # Portfolio from MonteCarlo simulation

plt.bar(x + width/2, portfolio_optimal_sr, width, label='Minimization') # Portfolio from minimization solution

# Add labels, title, and legend

plt.xlabel('Stock', fontsize=12)

plt.ylabel('Weight', fontsize=12)

plt.title('Optimal Portfolio based on Sharpe Ratio', fontsize=14)

plt.xticks(x, symbols, fontsize=10) # Set x-ticks to the names

plt.legend(fontsize=10)

# Show the plot

plt.tight_layout() # Adjust layout to prevent label overlap

plt.show()

# Historical performance

mc_sr_returns = np.dot(portfolio_mc_sr,daily_returns.transpose())

optimal_sr_returns = np.dot(portfolio_optimal_sr,daily_returns.transpose())

# Cumulative returns

cumulative_mc_sr_returns = (1 + mc_sr_returns).cumprod() - 1

cumulative_mc_sr_returns_perc = pd.Series(cumulative_mc_sr_returns*100, index=daily_returns.index)

cumulative_optimal_sr_returns = (1 + optimal_sr_returns).cumprod() - 1

cumulative_optimal_sr_returns_perc = pd.Series(cumulative_optimal_sr_returns*100, index=daily_returns.index)

cumulative_mc_sr_returns_perc.plot(figsize=(10,5), label='MonteCarlo')

cumulative_optimal_sr_returns_perc.plot(figsize=(10,5), label='Optimization')

plt.title('Historical Performance', fontsize=14)

plt.legend(fontsize=10);

# Plot the histogram

plt.figure(figsize=(12, 3))

plt.hist(mc_sr_returns, bins=100, label='MonteCarlo')

plt.hist(optimal_sr_returns, bins=100, alpha=0.7, label='Minimization')

plt.legend(fontsize=10)

# Show the plot

plt.tight_layout()

plt.show()

stats = {

'Montecarlo': {

'Returns': calculate_returns(portfolio_mc_sr),

'Volatility': calculate_volatility(portfolio_mc_sr),

'Sharpe Ratio': calculate_returns(portfolio_mc_sr)/calculate_volatility(portfolio_mc_sr)

},

'Minimization': {

'Returns': calculate_returns(portfolio_optimal_sr),

'Volatility': calculate_volatility(portfolio_optimal_sr),

'Sharpe Ratio': calculate_returns(portfolio_optimal_sr)/calculate_volatility(portfolio_optimal_sr)

}

}

pd.DataFrame(stats)

| Montecarlo | Minimization | |

|---|---|---|

| Returns | 0.204399 | 0.198496 |

| Volatility | 0.214235 | 0.206010 |

| Sharpe Ratio | 0.954086 | 0.963527 |

Efficient Frontier¶

The efficient frontier is the set of optimal portfolios that offers the highest expected return for a defined level of risk or the lowest risk for a given level of expected return. Portfolios that lie below the efficient frontier are sub-optimal, because they do not provide enough return for the level of risk. Portfolios that cluster to the right of the efficient frontier are also sub-optimal, because they have a higher level of risk for the defined rate of return

# Expected Return Range

expected_returns_range = np.linspace(0.01,0.35,100)

# Constraints

constraints = ({'type':'eq','fun': lambda weight: np.sum(weight)-1},

{'type':'eq','fun': lambda weight: calculate_returns(weight) - possible_return})

# Now loop for different expected returns:

frontier_volatility = []

weights_opt = pd.DataFrame(columns=range(n))

for possible_return in expected_returns_range:

# function for return

result = minimize(calculate_volatility,equal_weights,bounds=bounds,constraints=constraints)

frontier_volatility.append(result['fun'])

weights_opt = pd.concat([weights_opt, pd.DataFrame(result['x']).T])

Plot Efficient Frontier¶

plt.figure(figsize=(12,8))

plt.scatter(mc_portfolio_vol,mc_portfolio_returns,c=mc_sharpe_ratios)

plt.ylabel('Expected Returns')

plt.xlabel('Expected Volatility')

plt.colorbar(label='Sharpe Ratio')

# Add frontier line

plt.plot(frontier_volatility,expected_returns_range,'r-',linewidth=4);